Microfinance Pricing Report: Tanzania

Available Downloads

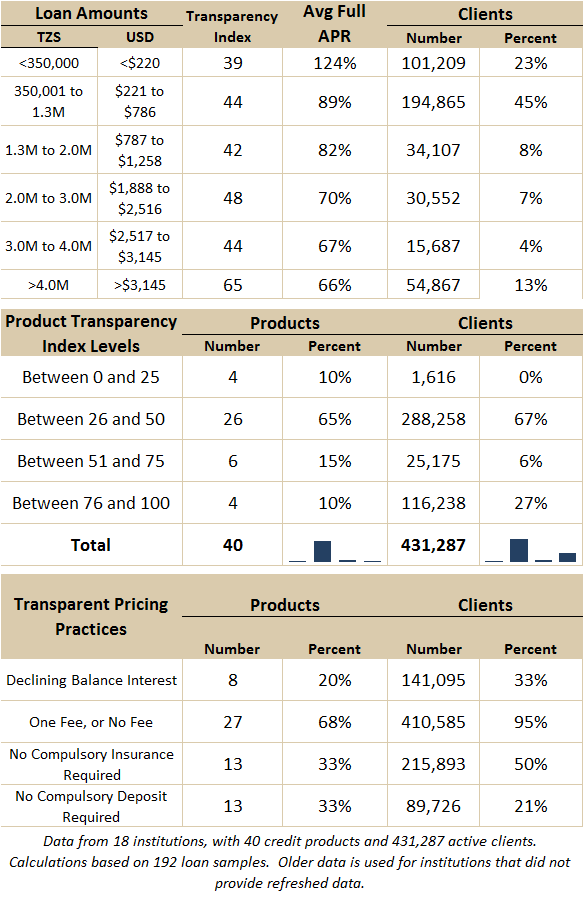

Languages available: EnglishThe Tanzania Microfinance Pricing Report 2013 presents in-depth analysis of the prices paid by microfinance borrowers in Tanzania. The report draws out key themes, features and trends in pricing, basing its analysis on prices calculated using original loan documentation representing real client loans in Tanzania. The report covers the loan products accessed by 431,827 of Tanzania’s borrowers, representing 92% of the total market.

This analytical report was prepared by MFTransparency in partnership with Planet Rating and with funding from MasterCard Foundation. Further data collected via the Transparent Pricing Initiative can be seen, downloaded and interacted with on the Tanzania pages of MFTransparency’s Pricing Data Platform.

Executive Summary

- The institutional level Pricing Transparency Index ranges widely from 12 to 89 in Tanzania. Twelve products showed improvements in their Transparency Index between 2011 and 2013, while six products had less transparent prices.

- Around a quarter of borrowers benefit from loans priced transparently, however 73% of them receive loans with a Transparency Index below 75/100

- This transparency level is explained by pricing practices consisting of multiple price components: 67% of borrowers receive loans which incur interest calculated using a flat interest method; 80% of borrowers pay fees in addition to the interest rate; 50% of borrowers pay a compulsory insurance fee; and 79% must provide compulsory deposits.

- Prices follow the standard price curve, with prices dropping as loan size increases. Prices average 124% on loans less than $220 then flatten and plateau at around 70% for larger micro-loans.

No Comments